WEST BEND — The city announced on Tuesday that it will receive federal funding, in the amount of $1.25 million, for the resurfacing of Paradise Drive from Main Street to the Eisenbahn Trail through the Surface Transportation Program-Urban that is administered by the Wisconsin Department of Transportation.

Through the STP-U program, 80% of the resurfacing cost will be covered by federal funds, with West Bend covering the remaining 20% of project costs. According to a news release, of the $1.25 million in federal funding, $91,084 will go toward the design phase of the project and $1,158,917 will go to the construction phase of the project.

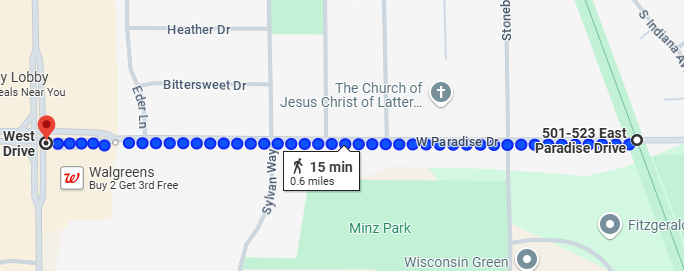

Here is the route that this is about:

0.6 miles. Roughly 1,000 feet. Ten football fields. $1.56 MILLION to just resurface it. Let’s start with that. That’s expensive. Why is it so expensive? Yes, asphalt is petroleum-based and the cost of materials is high. But we’re not talking any underground work or changes. It’s just resurfacing. That’s $1,500 per YARD of road.

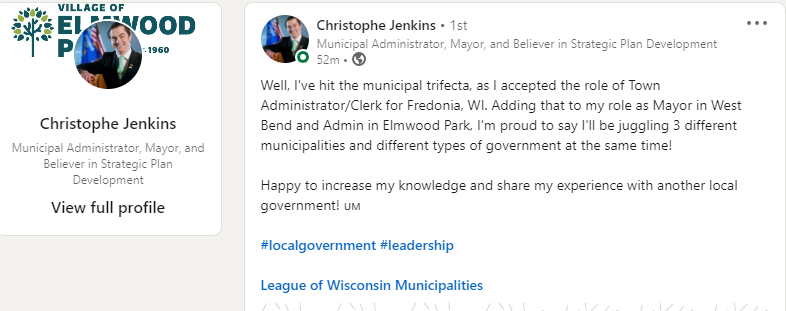

And what is this?

$91,084 will go toward the design phase of the project

That’s just the federal contribution, so over $100k to design… what? It’s resurfacing an existing road. What the hell are they designing? Who is being paid to design it? The city has a city engineer on staff. What the hell is he doing?

Furthermore, why are our federal dollars going to this at all? Why is it the interest of taxpayers in any other town or state in our nation to resurface half a mile of a local road in West Bend, Wisconsin? There is an insane amount of filtering that that money goes through before getting to the project and it comes with all sorts of strings. It’s an incredible amount of waste and not the role of the federal government or the national taxpayers.

Then, the cherry…

“We are excited about the approval of this federal funding,” City Engineer Max Marechal said in the release. “This funding is crucial for improving our city roads. We thank WisDOT for their support and look forward to starting construction in 2028.”

2028!?!? FOUR YEARS FROM NOW!?!? TO START!?!?

If you want a perfect example of how dysfunctional and wasteful our government is, I give you the resurfacing project for a half-mile stretch of road in West Bend, frickin’ Wisconsin.