For reference, here is my column that ran in the Washington County Daily News after the legislature finished their work:

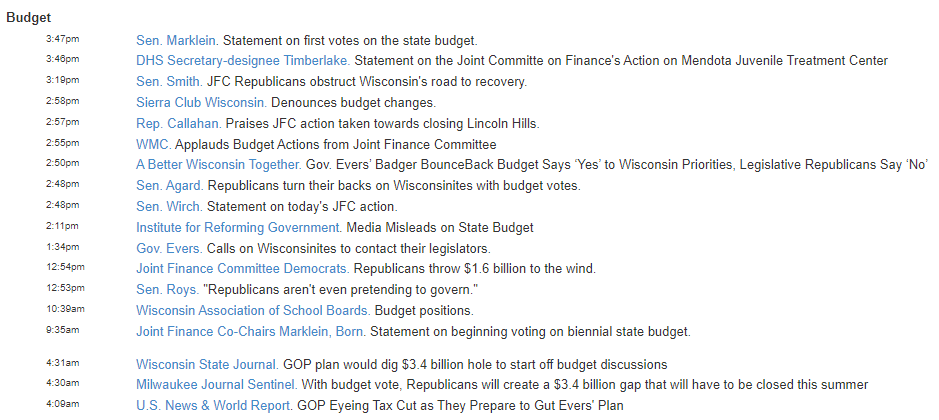

At the time of the writing of this column, the Republican-led Legislature has passed a biennial state budget and sent it to Gov. Tony Evers’ desk for his signature. Evers is likely to sign the budget, but only after exercising his powerful line-item veto to make it more to his liberal liking. That being the case, the budget passed by the Legislature represents the most conservative version of the budget that was passed by a legislature with very strong Republican majorities.

From a conservative’s perspective, there is not much to get excited about in the Republican budget. There is a significant income tax cut. If that survives Evers’ veto, then it is a significant win that lets taxpayers keep significantly more of the money they earn.

There are also a few smaller conservative wins, like defunding the University of Wisconsin System’s culturally destructive and expensive diversity, equity and inclusion enforcers, but the only other significant conservative wins in this budget are the myriad bad ideas that were in the governor’s budget that the Republicans declined to include. But the absence of leftist ideas does not make it a conservative budget.

The Republican-approved budget comprises a very lengthy list of spending increases. It includes about a $1 billion increase in spending for government K-12 schools. Most of that is in the form of direct state spending, but the remainder is in the form of allowing local districts to increase property taxes. This is the largest single spending increase on government schools in state history and is happening in an age of declining enrollment and plummeting performance.

The budget includes another historic spending increase of $2.4 billion for capital building projects.

Part of the reason for the building boom is that the Republicans are paying for about half of the spending increase with cash from the previous budget’s surplus, thus reducing the reliance on debt, and using cash to pay off about $400 million in debt. Using cash to fund capital projects instead of using debt is only a good decision if one accepts that the projects are necessary. Either way, it is another huge spending increase.

There is a substantial pay increase for state employees, University of Wisconsin System employees, corrections employees, prosecutors, and public defenders. In the Biden economy with runaway inflation, many of these employee raises are likely necessary, but the Republicans failed to bind pay increases with staff reductions. Except for a few departments in state government, like the Department of Corrections, the state’s payroll remains bloated and inefficient.

The Republican budget has an increase in transit spending, half a billion dollars for housing programs, $125 million more for PFAS cleanup, and, of course, the funding for the (yet another) historic $275 million spending increase in shared revenue. There is even $2 million for the Green Bay Packers to help pay to host the NFL Draft. A few million here and half a billion there and it starts to add up.

All in, the budget that the Republican Legislature passed — before Governor Evers makes it worse with his veto pen — spends $97,407,275,400 over two years. That is a whopping 9.2% increase in spending over the previous budget. They managed to just squeak under a double-digit spending increase.

Lest one thinks that the spending is being driven by additional federal funds, the general fund, which is the state’s main checking account, is spending 11.5% more than the previous budget.

Even with huge legislative majorities, the Republicans’ best proposal is to grow government by almost 10%. That is pathetic. It is difficult for this conservative to muster the vim to rally behind the elephants when the output of the effort is just a larger government with a few conservative baubles as distractions.

As we celebrate our Independence Day from the oppression of arbitrary and oppressive government, I took the opportunity to, once again, read our hallowed Declaration of Independence. One feels the frustration building throughout the document. We appear to be at this point in the cycle of liberty:

“… all experience hath shewn, that mankind are more disposed to suffer, while evils are sufferable, than to right themselves by abolishing the forms to which they are accustomed.”